will salt deduction be eliminated

You have two options for calculating your sales tax deduction if you. Many aspects of the TCJA are scheduled to sunset or expire in 2025 including the SALT deduction limit.

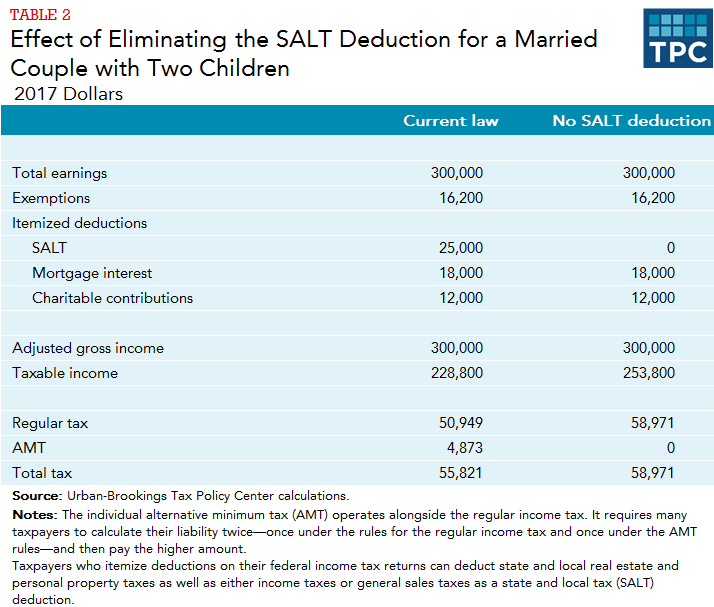

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The Two Options for Calculating Sales Tax.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

. Tax Reform Tax Tip 2019-140 Tax Reform Tax Tip 2019-27 Tax Reform Tax Tip 2019-35. Personal exemption deductions for yourself your spouse or your dependents have been eliminated beginning after December 31 2017 and before January 1 2026. Personal Exemption Deduction Eliminated.

Its possible this limit will be eliminated in future years unless Congress acts to renew some or all of the TCJA provisions that are set to expire.

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

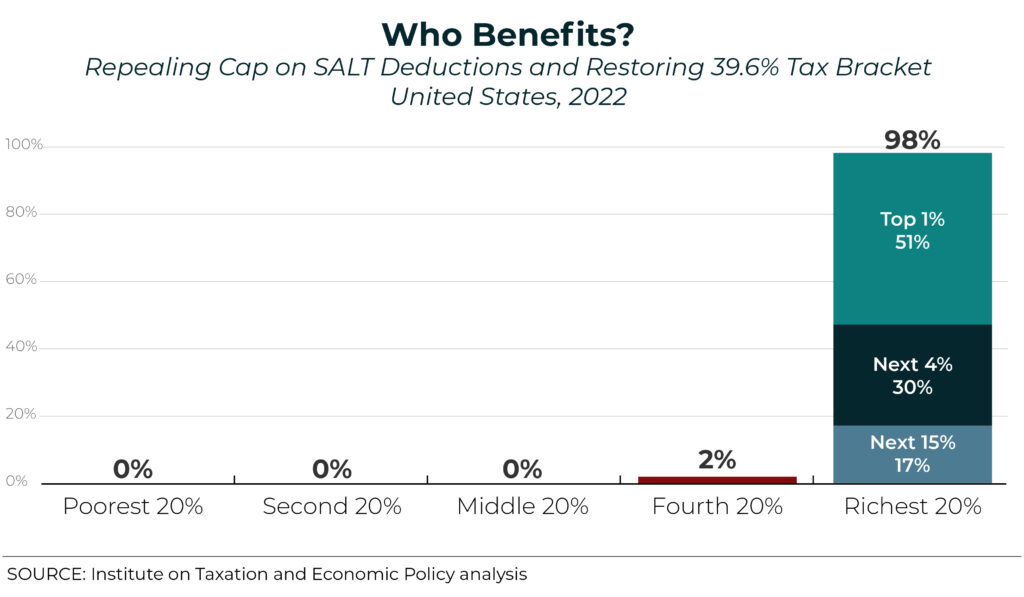

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

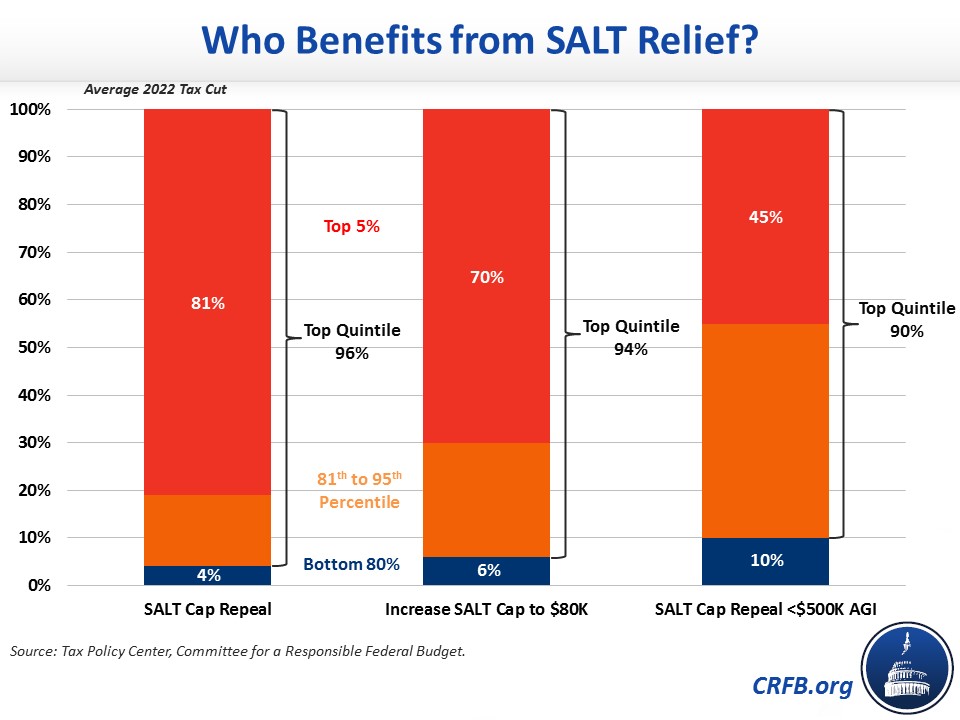

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center